AlTareq is a key enabler of Open Finance in the UAE and its impact will be most visible in how payments are made across industries. Designed by the Central Bank as the trust framework behind the country’s Open Finance rollout, AlTareq introduces a standardized, secure way for consumers and businesses to make payments directly from bank accounts.

This article explains how AlTareq supports the growth of account-to-account payments, what it means for merchants and platforms, and how it’s reshaping the financial infrastructure of the UAE.

AlTareq serves two purposes. First, it provides a consistent identity and interface for Open Finance services across the UAE. Second, it ensures that all participants (from banks to fintechs) adhere to the same security and operational standards when enabling payment initiation and other financial services.

This consistency matters especially for payments, where reliability, speed, and trust are critical. The presence of the AlTareq brand in a payment flow signals to users that the process is secure, regulated, and endorsed by the Central Bank.

Lean Technologies and AlTareq are regulated by the Central Bank of the UAE.

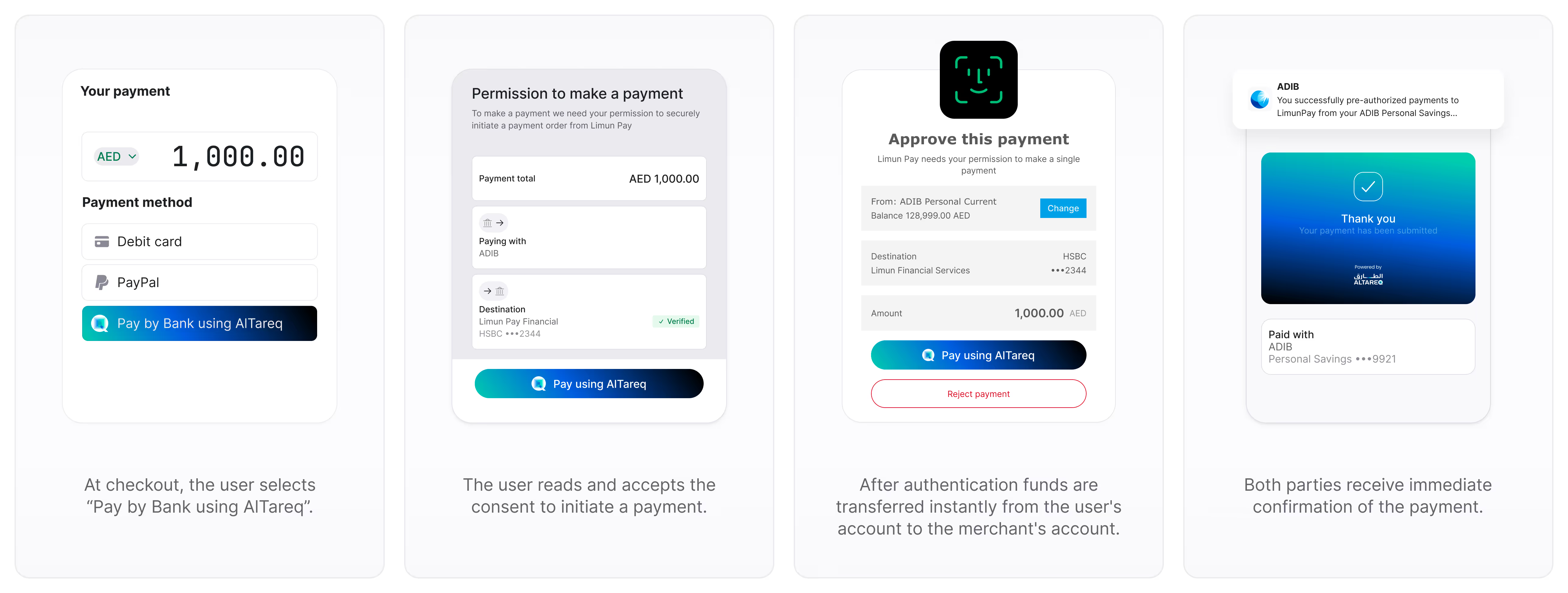

Under AlTareq, licensed entities can offer payment initiation services that let users pay merchants directly from their bank accounts. These services are integrated into checkout flows or mobile apps through secure APIs.

The result is a seamless flow:

This method bypasses cards, wallets, and other intermediaries, reducing the number of parties involved and lowering the overall cost of the transaction.

By standardising Open Finance implementation and encouraging adoption, AlTareq creates a level playing field for businesses to offer modern payment solutions. Merchants and platforms can expect:

This isn’t just a technological shift, it’s an economic one, allowing businesses to retain more margin while offering smoother checkout journeys.

With AlTareq as a unifying brand and standard, Open Finance payments are positioned to become the default across digital commerce in the UAE. Over time, users will grow familiar with bank payments as a faster, more secure alternative to cards.

The more visible the AlTareq brand becomes, the more trusted and widespread Open Finance payments will be.

At Lean, we’ve been closely working with the AlTareq initiative to ensure our solutions fully comply with their framework. Here’s how we’re supporting:

Open Finance gives you control over your financial data and services. With your permission, it lets you securely share your bank, insurance, mortgage, and other financial information and initiate services via regulated providers to access more personalised, innovative, and convenient financial services.

Open Finance is known as AlTareq in the UAE. You will see this name and logo when using Open Finance services provided by banks or insurers, exchange houses or brokers, and Third-Party Providers.

Examples include:

TThe Central Bank of the UAE (CBUAE) launched Open Finance to modernise the financial sector and give you more choice and convenience.

AlTareq, the name for Open Finance in the UAE, will offer functionality that securely connects all Licensed Financial Institutions and Third-Party Providers/apps via a central platform.

Open Finance will support four key functionalities including:

Open Finance is governed by principles that value consumer rights, access to financial data, ease of using services, and enhancing functionality and transparency.

Nebras website: nebrasopenfinance.ae

With your explicit consent, Open Finance allows regulated TPPs to securely connect to banks, insurance companies, exchange houses, and other organisations.

The connection is made via an Application Programming Interface (API); this is the same type of connection your mobile phone uses to connect your photos app to your social media apps. However, we add the highest grade of security to the connection.

This enables TPPs to offer enhanced financial products and services tailored to your needs.

Open Finance empowers both individuals and businesses by providing them with access to an enhanced range of financial products and services.

You can access Open Finance services through regulated TPP apps or platforms once you give consent for data sharing/service initiation to a specific provider.

The AlTareq Consent Mobile App allows you to give permission and manage what financial data you share through Open Finance.

It’s a trusted, centralised app that lets you approve payments, share data, and control all your consents, in one place, across LFIs and TPPs.

No, Open Finance is completely voluntary. You will need to actively give consent before any data is shared or services are provided.

You can manage or cancel your consent at any time through:

Open Finance enhances how you access and leverage financial services through:

You can find more information on the Nebras website: nebrasopenfinance.ae

Yes, your safety and privacy are at the heart of Open Finance. Only providers that are licensed and regulated by the CBUAE can access your data, and only with your clear, informed consent.

Open Finance is built with world-class levels of protection, using advanced security tools like multi-factor authentication and encryption to ensure your information and the financial services you avail stay private and secure.

Open Finance uses multiple layers of protection to ensure security:

Multi-factor authentication adds an extra layer of security to verify your identity when giving consent to data sharing or service initiation.

It requires you to provide at least two of the following forms of identification:

Consent will be initiated through your TPP’s app and consent authorisation will be confirmed either through your LFI’s app or the AlTareq Consent Mobile App.

You can view, pause, or cancel your consent at any time through any of the above-mentioned platforms.

With your consent, Open Finance allows the sharing of:

You can revoke or temporarily suspend consent through:

You can view, pause, or cancel your consent at any time.

Consent automatically expires after one year. You will need to extend consent if you want the AlTareq-based services to continue.

You can also temporarily suspend or completely revoke consent at any time through your LFI/TPP platform or the AlTareq Consent Mobile App.

You have control over your personal data. You decide who sees your data, what they see, and when they can see it.

You can stop providing access at any time and when you do, the TPPs are obliged to delete your data which is not required to be retained by law or regulation.

Yes, the CBUAE Open Finance Regulation establishes a comprehensive framework for the licensing, supervision, and operation of Open Finance in the UAE.

If a security breach occurs, the bank, insurer, or TPP must notify you immediately and address the issue.

There is a comprehensive liability model for AlTareq which compensates users in the event of any performance issue or security breach, in addition to the protection provided by UAE law.

If suspicious activity is detected, the LFI may trigger security protocols, such as requiring additional authentication, temporarily blocking transactions, or notifying the user for manual verification.

You can find this information in the AlTareq directory on the Nebras website.

Open Finance supports initiating a variety of payments with your explicit consent, including:

Your bank or other LFI will still make the payment initiated by the TPP.

You can track Open Finance payments through your LFI’s platform or the TPP that initiated the transaction.

If an Open Finance payment fails, the concerned TPP or LFI will immediately notify you of the transaction failure.

Possible reasons include insufficient funds, authentication errors, or a processing error at the receiving institution.

LFIs and TPPs are required to deliver a consistent and user-friendly digital experience by Nebras.

This includes:

You should first raise the concern with the relevant LFI or TPP involved.

If the issue remains unresolved, it may be reviewed by Nebras and the CBUAE. If still unresolved, you can escalate the matter to Sanadak.

Sanadak is an impartial entity dedicated to investigating and resolving complaints from users in the financial services sector.

Sanadak handles: